Savings Rates, Security, and Strategies

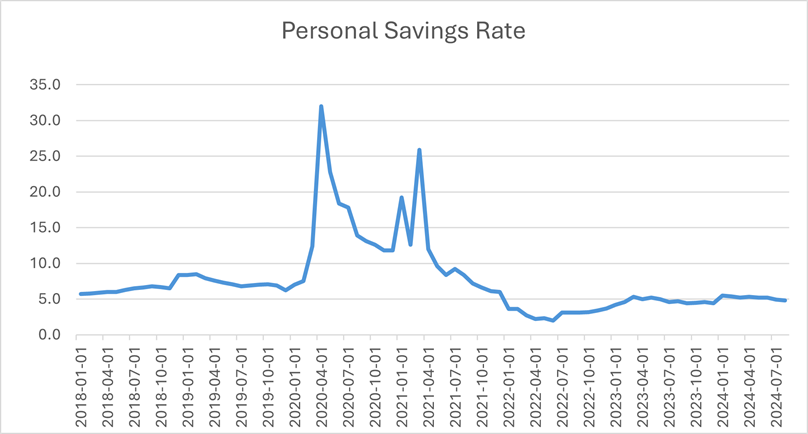

The rate of personal savings has had dramatic ups and downs over the last several years. It fell to a near-historic low of two percent in 2022 in comparison to a high of 32% in 2020, the first year of the pandemic. Prior to the pandemic, the personal savings rate ranged from six percent to over eight percent. In the years following the pandemic, the savings rate has flattened out at about five percent.

Below is a chart showing the personal savings rate from 2018:

Source: U.S Bureau of Economic Analysis: Federal Reserve Bank of St. Louis, FRED Economic Data, Personal Saving Rate

Many of us were able to save at historic levels during the pandemic as spending was curbed, student loans were paused, and the stimulus package provided some extra cash. However, when the world opened up, not only did spending opportunities arise, but inflation became part of the picture. For those not reviewing their spending plan, their savings rate could have unintentionally dropped to unexpected levels. For many, the drop in savings rate was unavoidable as the cost of necessities, including rent and food, increased. For others, the pent-up demand for travel and other expenditures took precedence.

Whatever the cause for the change, it pays to take a step back to review your financial objectives, identify changes in your financial landscape, and revise your spending plan as necessary. Is it a short-term drop in savings due to a job or living situation change or have your basic expenditures changed? This is the time to review, reflect, and adjust; revisit your financial objectives and establish a spending plan, including a savings rate to help achieve your goals – both short-term and long-term.

In addition to reaffirming your savings goals, now is also the time to reevaluate where you have placed your money. If your financial objectives are short-term (say in the next three to four years) – for example, setting aside savings for tuition, a car, or a down payment – there are more options for where to put your money. Now is a good time to seek out safe places to deposit your savings and maximize yields.

Safety and Security

The safety and security of your deposits in financial institutions has been in the news as of late. You’ll want to make sure that your deposits are FDIC-insured. You can check whether the Federal Deposit Insurance Corporation (FDIC) insures a specific bank or savings association by calling the FDIC at 877-275-3342 or using FDIC’s BankFind. Credit unions have similar insurance coverage through the National Credit Union Administration (NCUA). Both insure deposits up to $250,000.

Yield

While interest rates have declined over the past few months, there continue to be options to capture higher yields. Again, always check to ensure that your deposits are insured through the FDIC or NCUA.

- High-yield savings account – High-yield savings accounts have higher rates than your traditional savings accounts. You can maximize your savings with a high-yield account, but you’ll also want to look at minimum balance requirements, fees, and any withdrawal limitations.

- Certificate of Deposit (CD) – You’ll want to shop around for the best CD rates. The rates can vary greatly between institutions. With a CD, you agree to tie up your money for a specific period of time – say three, six, nine, or 12 months. The longer the period that you agree to let the bank or credit union hold onto your money, the higher the interest rate. Depending upon your financial goals and liquidity needs, CDs can be a good option. Generally, there are penalties if you withdraw early, so you’ll want to align the duration of the CD with your cash flow needs.

- I Bond – I bonds are issued by the U.S. Treasury. They are designed to protect the value of your cash from inflation. When inflation was rising, these bonds attracted much attention. However, they’ve become less attractive as inflation has stabilized. In addition, there are several restrictions on I bonds. First, they must be purchased directly from the TreasuryDirect website. But once you’ve set up your account, you are set. You can only buy up to $10,000 worth of I bonds annually, with the possibility to purchase another $5,000 with your tax refund, up to a total annual purchase of $15,000 per person per year. There are also restrictions on cashing out the bonds. An I bond cannot be cashed for the first year, and if you cash the bond in years two to five, you forfeit the prior three months of interest. While these bonds have a number of restrictions, they are currently offering a very attractive yield.

- Money Market Account (MMA) – MMAs are offered by banks and credit unions. They offer slightly higher returns, and some checking account features, although with restrictions. Traditionally they have minimum balance requirements, and the interest rate you earn may vary depending upon your balance in the account. You may withdraw your money at any time, however, there may be limits on the number of withdrawals or transfers you can make in a given period.

Now is the time to check your personal savings rate, particularly noting if it has changed. If it’s lower, revisit your spending plan to ensure that your savings rate aligns with your financial objectives. Finally, make sure that your hard-earned savings are working for you. In the current environment there are numerous options to optimize returns.

Next Step: Schedule free 30-minute calls with Accredited Financial Counselors from AccessLex Institute® through AccessConnex to talk about savings goals, vehicles, and ideas that could make sense for you.